Stop orders and other order types

No broker offers more order types than WH SELFINVEST. Order types are a key to your trading success.

More than 15 stop orders are available. You also have buy stop orders, orders based on time, and much more.

More order types than any other broker.

More stop order types than any other broker.

Guaranteed stops available, but not obligatory.

Stops can be placed on trend-lines and trend-channels.

Indicators can be used as stops.

Stop orders can be placed automatically after a position is opened.

In a single click one order type can be converted into another.

No programming required. Simply click and trade.

Opening an account is FREE. There is no monthly inactivity fee.

Stop orders, your key to success

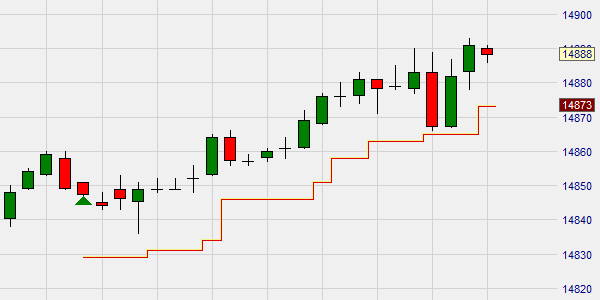

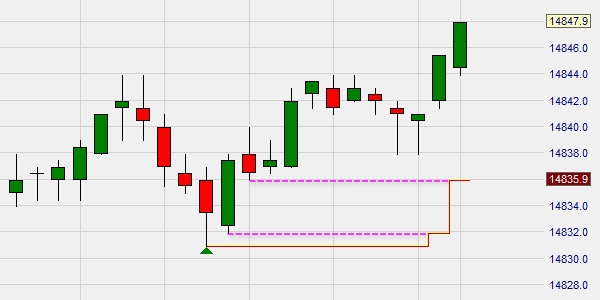

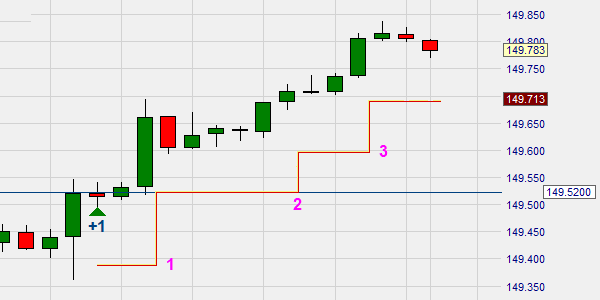

1. The trailing stop

A trailing stop order follows the market price when it goes up. When the market price goes down or sideways, the stop stays in place. The distance between the market price and the stop price is specified by the trader.

In this example the trailing stop order moves sideways when the market moves sideways. When the market rises, the trailing stop follows.

The distance between the market price and the trailing stop can be set in percentage, volatility or price terms. For example, by selecting 0,25 the trader has a trailing stop 0,25% below the market price.

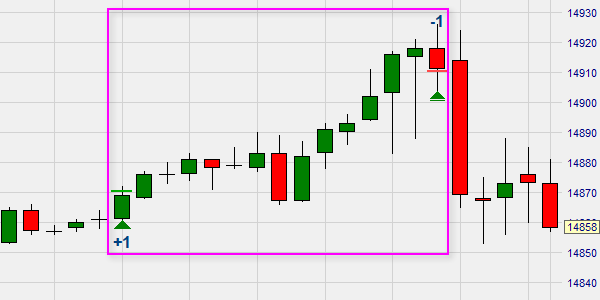

2. The time stop

The time stop order closes a position after a certain time period expires. In this example the trader instructed the time stop to closed the position after 15 candles.

The time stop is often used in break-out strategies, which usually make their biggest profit in the first candles.

FREE Newsletter for Traders

New indicators, new strategies... everything you need to know.

You can unsubscribe at any moment.

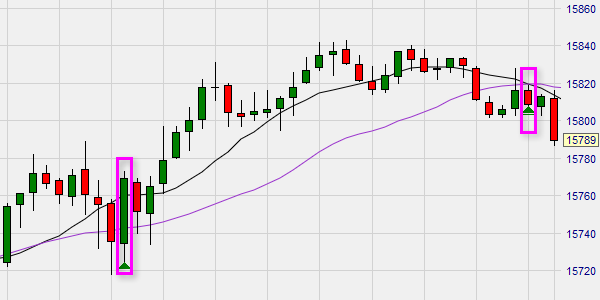

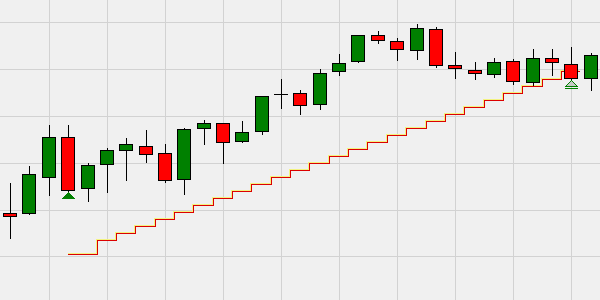

Register now3. The indicator stop

Every technical analysis indicator can be used to trigger an order. Combinations of indicators can also be used. In this example, the trader bought a position after a bullish cross of two moving averages. The position is closed automatically when the bearish cross occurs.

Easy automated trading based on indicators is possible with TacticOrders.

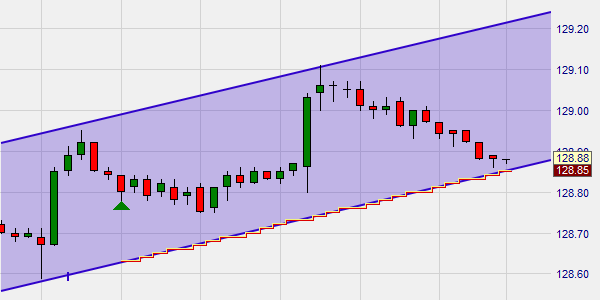

4. Trend-line stop and trend-channel stop

Stop orders can be placed on trend-lines and trend-channels. In this example the stop order is placed on a trend-channel. The stop automatically follows the trend-channel. If the market price drops out of the trend-channel, the stop is hit and the position is automatically closed. Another unique NanoTrader functionality.

Notice how the stop order evolves in steps. The stop must follow price levels on which it can trade. This future, for example, trades in ticks of 0,5. The price evolves 100,0 > 100,5 > 101,0 etc.

5. The fixed stop (or click stop)

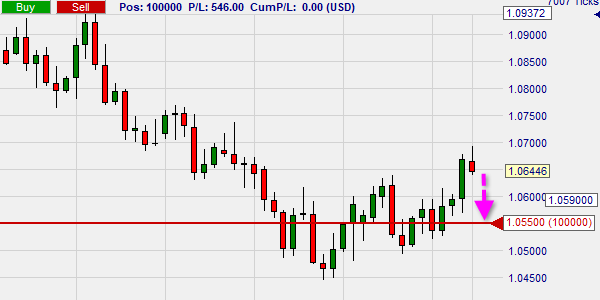

The fixed stop or click stop is the classic stop loss order most traders know. The trader specifies a price level. When the market reaches the price level, a market order is released and executed.

In this example the market price is 1,06446 and the stop is 1,05500. If the market price drops to the stop, the position is automatically closed at the market price.

To change the stop level, the red line in the chart can simply be grabbed and moved to another price level.

"Thank you very much for your detailed explanation.

I am always impressed with the good support at WH

SelfInvest. " - Barbara

Open an account too

"Thank you very much for the super fast and

professional service, I am very glad that I ended up with

WH SelfInvest." - Eddie

Open an account too

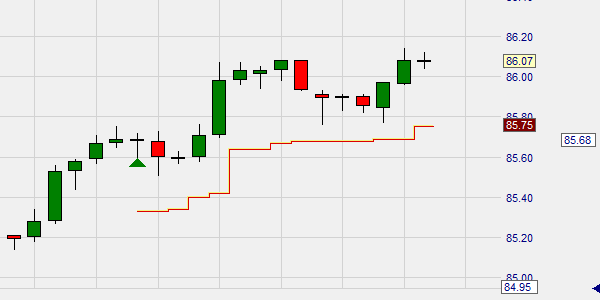

6. The linear stop

The linear stop order is a stop which automatically increases its activation trigger with a fixed value every period. In this example the stop increases every period with 2,5 points. Some traders prefer the linear stop to the trailing stop. The linear stop does not go sideways when the market goes sideways or down.

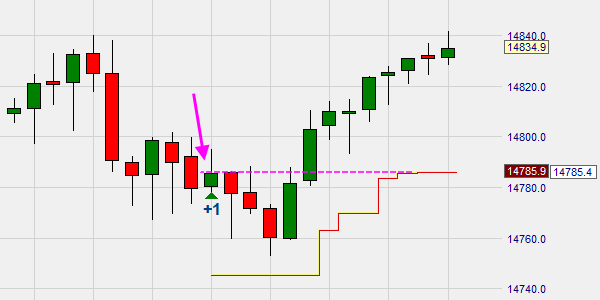

7. The break-even stop

The break-even stop is a stop order which automatically increases the stop until a specified level is reached. Before reaching this level the break-even stop operates like a trailing stop. The trader specifies the level, which must be above the entry price i.e; the trader's break-even level. Hence the name break-even stop.

In this example the stop level is now fixed at 5 ticks above the entry price (small green line indicated by arrow). This trader can never lose money.

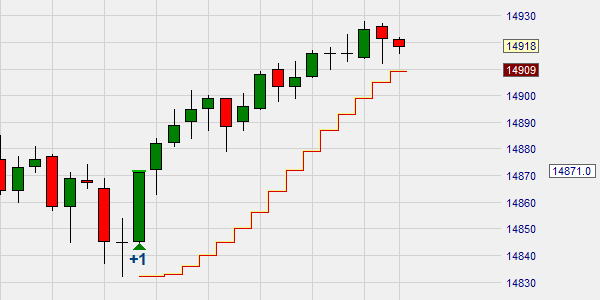

8. The periods high-low stop

The periods high-low stop order is simply a stop with the stop level based on the lowest (or highest) price over a certain period of time.

This trader bought a position. The stop (red line) is automatically moved up to the lowest price of the last 10 periods. The lowest price levels are indicated by the dotted lines.

Many professional traders use this stop because it often increases profit. It can pay to experiment with this stop when developing a trading strategy.

9. The kasedev stop

The kasedev stop order calculates a new stop level at the end of every period. The level is calculated by using the market volatility.

This example shows the stop going up fast when there is volatility, and slow when there is no volatility.

This stop is not well-known but can increase profits. It is a stop worth experimenting with. Every client gets a free permanent demo account to experiment!

10. The average price stop

The average price stop order places the stop on the average entry price. A trader, building his position in steps, can click a Tactic button to move his stop to his next average price when he adds to his position.

In this example two positions were bought, one after the other. The stop is now at the average entry price.

11. The parabolic stop

The parabolic stop places the stop level closer and closer to the market price as time elapses. The trader decides the shape of the parabola by setting both the horizontal and the vertical movements.

This example clearly shows the typical acceleration and shape of a parabola as time elapses.

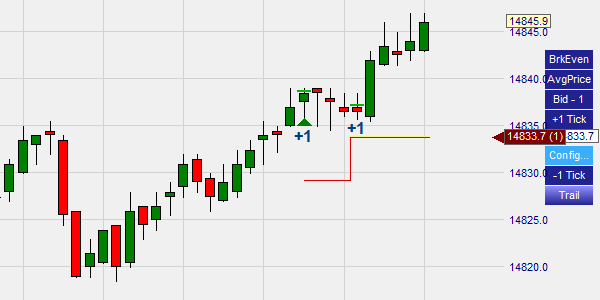

12. The BETrail stop

The BETrail stop (Break-Even Trailing stop) is nearly a complete trading strategy on its own.

The trader specifies three price levels for consecutive stop orders. The initial stop -a classic fixed stop- is automatically placed when the position is opened. When the market climbs above the trader's entry price, the stop automatically increases to the entry price (or above, if so desired). When the market continues to climb, the stop converts into a trailing stop.

This example shows the initial stop (1), the break-even stop at the entry price (2) and, finally, the trailing stop (3).

13. The timed stop (or flat filter)

The timed stop, usually called flat filter, closes a position at a specific point in time. This example shows a flat filter which closed a position at 18h00. The flat filter colours the chart background as a visual reminder.

This example shows the stop going up fast when there is volatility, and slow when there is no volatility.

This stop is frequently used by traders to avoid keeping positions overnight. They set the time just before market close and NanoTrader closes the position automatically.

Orders based on time

Time instructions can be added to orders. Create an order, which is only live during particular hours of the day. Create an order, which closes a position at a precise moment in time. These are a few examples of what is possible in the award-winning NanoTrader.

"So far, I am very satisfied with the whole support provided by WHS. I can only confirm the client satisfaction as emphasised in WHS marketing after my short time as a user." - Klaus

"Many compliments on your customer-friendliness. Questions are answered quickly and accurately. Very special in this day and age. You don't often come across that anymore." - René

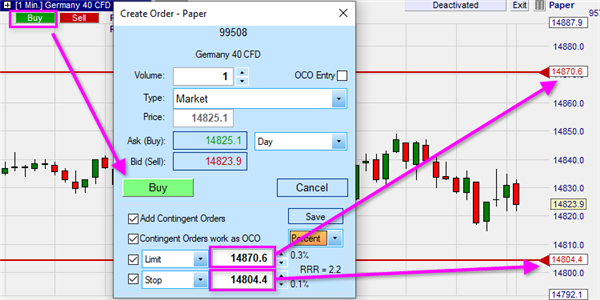

Bracket orders and chart orders

The optimal protection of your position

Clicking the Buy or Sell buttons in a chart opens the order ticket. This trader intends to place a market order. By selecting "Add Contingent Orders" in the ticket, the traders instructs the platform to automatically place a profit target order and a stop order after the position is open.

The red lines indicate the two bracket orders. By grabbing the red lines it is possible to slide the orders to a different price level. When one of the orders is executed, the other is automatically cancelled.

Click the chart to place orders

Orders can be placed via the charts. Find out how to place chart orders, indicator orders and trade wizard orders.

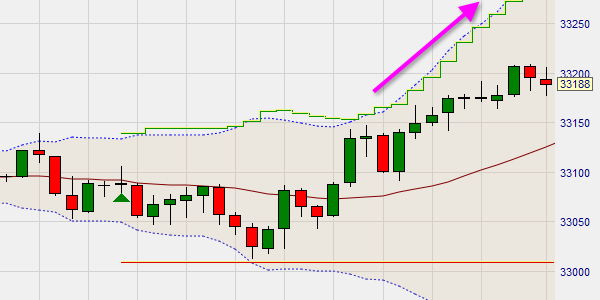

Trailing target orders

Extract the maximum profit from a position!

The trailing target increases the profit target, if the market goes up. No other broker has trailing target orders.

In this example the trader bought a position. The market goes up. The profit target order follows the Bollinger Band. By automatically raising the profit target in a strong market, traders make more profit. Yet another functionality, which makes the NanoTrader unique.

Quick and easy account opening

Trade with an award-winning broker.

No monthly inactivity fee

FREE trading strategies and signals.

Unique trading store.

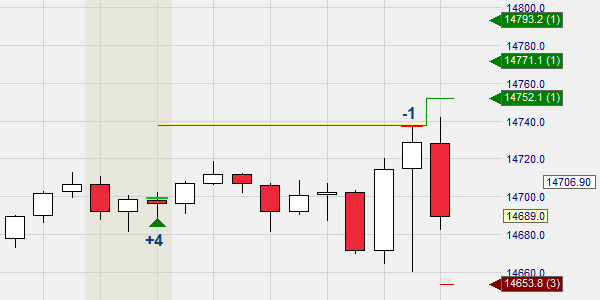

Open an accountMultiple target and stop orders

Many experienced traders open and close positions in steps. NanoTrader is the only trading platform, which can handle more than two profit target and/or stop orders. NanoTrader is also the only platform capable of automatically(!) adapting the order quantities of live orders when positions are sold and bought one after the other.

This trader bought four futures contracts. One already reached its profit target. The three remaining contracts, each have a different profit target.

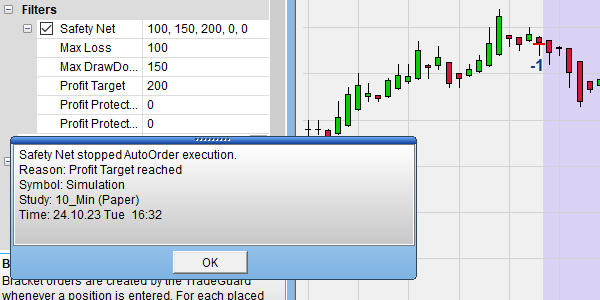

The Safety Net

Feel safe during automated trading.

The Safety Net stops automated trading and closes the position when an event occurs. The trader can select one or more of these four:

- A maximum loss is reached

- A maximum profit is reached

- A maximum drawdown occurs

- After a certain profit level is reached, a maximum drawdown occurs

NanoTrader is strongly recommended by many professional traders: