News AND NOVELTIES

Best broker – 11/2025

After conducting thorough market research, Brokervergleich.de has declared WH SelfInvest to be one of the best CFD-Forex brokers. A top score in Service & Security and Broker Services is perfect for your trading. Their market research is based on the opinions of customers and experts.

Event in Marseille – 06/2025

A lot of enthusiasm in Marseille. Clients and prospects benefited free of charge from three high-level traders: 'Mastering the art of analysing institutional movements', 'How to optimise your scalping thanks to the order book' and 'Trading futures on full order books'. Become a client too.

Many happy traders – 10/2024

Prospects and clients commented that they had received a lot of interesting insights. Thorsten Eberhart, Urban Jaekle and the speakers from WH SelfInvest captivated the audience. We have the best and largest range of free webinars and seminars. We invite you to take part.

Everything for our clients – 9/2024

A full house. The Trading Workshop was a great success. Clients of WH SelfInvest can count on free trading training. Advanced traders and beginners were able to participate in trades with Paul Marcel, Eric Lefort and Raphaël Leblond. Don't hesitate to become a client too.

Portfolio management – 7/2024

Our Investui portfolio management service is doing great. In the first half of 2024, an average of € 1.147 was added to the € 25,000 reference account each month. The net return in 2024 is 27,5%. Investui delivers a better return than the main stock market indices and gold.

Friday Traders Club – 6/2024

Many clients were present in our office and online during the most recent Friday Traders Club. Trader Uwe Kälberer showed live how volume trading on futures works. The Friday Traders Club events are very hands-on. Clients can ask all their questions in a relaxed atmosphere.

Did you know? – 5/2024

You can also trade stocks and options via WH SelfInvest. Our Freestoxx service is a zero commission service for the US markets. Our multi-markets account is a cooperation with Interactive Brokers at the lowest commissions possible. In addition we have a huge CFD on stocks offer.

New GTAS version – 4/2024

The GTAS indicators leave no room for doubt or your own interpretation. It is black-white, on-off, start-stop. Because the method is so unambiguous, there is no emotional rollercoaster prompting traders to make mistakes. Seven years after its first publication, trader Prats-Desclaux treats GTAS fans to a new, more comprehensive version.

Success in Paris – 4/2024

Nicolas Schneller, Jonathan Hiel, Michael Rousselle, Guillaume Lidy and Sébastien Constant as well as associates gave very interesting talks in our special presentation area at the Salon de l'Anlyse Technique. The stand was also crowded with prospects and clients. Feel free to also sign up for a free seminar or webinar. There are new events every month.

Learn how to trade – 2/2024

Our Frankfurt offices were put at the disposal of one of our partners for an intensive trading seminar. The seminar lasted 4 days. Aspiring traders participated both in the office, and online. Every participant has a big individual work space. WH SelfInvest clients have exclusive unlimited access to probably the best events calendar in the industry. Open an account too.

Options specialist in action – 2/2024

Stefan Toetzke gave four rock-solid options presentations as part of our "Friday Traders Club". Both novice and advanced options traders can watch the presentation in the Frankfurt office or via the live stream. WH SELFINVEST offers options on futures. Traditional options are offered through the FREESTOXX brand.

The Traders' League – 1/2024

Welcome to Season 1 of "The Traders' League". Four professional traders battle it out all day on the financial markets in a fierce competition to win the prestigious Best Trader Cup. Our clients can come to the WH SelfInvest office in Paris and be present or watch the livestream from home.

The Friday Traders Club – 1/2024

Our RealMoneyTrader René Wolfram has been a permanent fixture for years. With an excellent presentation, he captivated the more than 700 people in the livestream as well as the many participants in the room. The lecture took place as part of the Friday Traders Club. WH SelfInvest clients have unlimited access to the best traders, coaches and lectures.

New Renko Plus charts – 1/2024

Our new Renko Plus charts are a sensation. They combine the best of both worlds. The additional Renko objective lines are very practical. There are special Renko Plus charts for scalpers and ultra short-term traders. The new Renko Plus charts are available for FREE to clients in the NanoTrader trading platform.

News from Switzerland – 12/2023

The WH SELFINVEST office in Zurich organised a high-quality seminar. Well-known German trader Birger Schäfermeier was one of the big crowd-pleasers. Active investing is becoming more and more popular in Switzerland. Swiss investors are also increasingly looking across their borders to find good brokers.

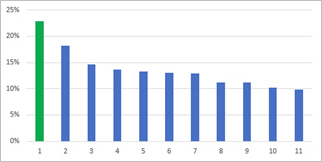

New thematic indices – 10/2023

Traders and investors can now trade these thematic indices: AI index, Blockchain index, China Internet Giants index, Electric Vehicles index and the Green index. In total, there are 11 thematic indexes.

New trading system – 10/2023

The new WL Timm trading system is available. It is a complete system for short term trading with 2 indicators, 4 strategies and 3 money management systems. You also need the WL Bars and the WL Triads. They are available FREE of charge in NanoTrader.

Profit from AI – 9/2023

You too can profit from the artificial intelligence revolution. The new AI Stock-Box is now available over at Freestoxx. This new stock portfolio uses the same method as our Nasdaq Stock-Box. The Nasdaq Stock-Box returned more than 200% since 2016.

Best Broker – August 2023

Nine is the number of consecutive times WH SelfInvest was voted Best Broker by the mystery shoppers of the Fuchs Report. Trading is not easy. Your broker and their platform is your most important tool on the way to success. Choose the best tool, choose WH SelfInvest. Even if you are satisfied with your current broker, test WH SelfInvest.

Trading seminar Switzerland – June 2023

Many Swiss investors and traders were present at our free trading seminar in Zürich. Several professional traders and WHS colleagues passed on their knowledge to the audience. Feel free to join us next time!

New client proposal – May 2023

A better moving average. Tim Tillson designed the Tillson average, also called T3 average. His average is described in detail in the well-known magazine Stocks & Commodities. The Tillson averages and the Tillson histogram can be used as trend filters and signals. They are FREE for all clients.

New client proposal – April 2023

The new Maximum Likelihood indicator is a step forward in trend trading. Traders can identify the trend early. The indicator also indicates when a trend is at its peak. This is the right moment to close your position. The Maximum Likelihood indicator can be used for day trading and swing trading on all instruments. The indicator is FREE for all clients.

WL Bars v02 – April 2023

The WL Bars have been further refined. Traders focusing on price movements are now even better equipped. User-friendliness is 100% better: the WL Bars can now be selected directly in the drop-down menu of chart types. WH SelfInvest is the only broker, who offers the WL Bars for FREE.

A major event – March 2023

WH SelfInvest was present on the Invest fair in Stuttgart. Two stands were available to receive clients and prospects. WH SelfInvest, for traders, shared a stand with Investui. Freestoxx had its own separate stand. Register in our calendar for free trading webinars and seminars.

New client proposal – March 2023

Well-known trader-investor Thomas DeMark uses his DeMark (DeMarker or DeM) indicator to generate trading signals. DeMark is interested in divergences between the market and his indicator. Signals can be traded manually or automatically. The DeMark indicator is FREE for all clients.

New: pre- and after-market CFDs – February 2023

Market studies confirm that one of the main reasons why clients choose their broker, is the size of the product range. We probably already have the largest CFD-Forex product range, yet we cannot resist expanding it so that you have the best of the best.You can now trade in the pre- and the after-market. 70 US stocks and ETFs are available. Trade from 10.00 in the morning to 02.00 at night.

Rave reviews for trading seminar – February 2023

Our Frankfurt office is THE place to be for free, quality trading seminars. Hundreds of other traders watched the streaming presentation. Trader Andre Stagge, along with NanoTrader specialist Stefan Fröhlich, captivated the audience. "They were very inspiring and gave us good and important additional insights." said a participant. Click here if you would like to attend an event.

New: The Expo Bounce day trading strategy – February 2023

Using an interesting combination of indicators, the Expo Bounce day strategy detects bounce backs in the market. The illustration is a typical example. The second arrow is the bounce back. The Expo Bounce strategy is available for FREE in NanoTrader.

Another successful free seminar - January 2023

Author and trading instructor Erdal Cene wowed the audience at the WH SelfInvest Frankfurt office. On Erdal's screen you can see the order books of the trading platform NanoTrader. With Erdal Cene as a speaker, everyone in the audience has to speak up and join in. The best trading events and the best trading speakers are always organised by the broker WH SelfInvest. Click here if you would like to attend an event.

A great event - January 2023

Our office in Frankfurt is known for its numerous high-profile trading events. At this event, Germany's best specialists dived into the fascinating topic of volume trading for futures with an enthusiastic audience. The broker WH SelfInvest is THE specialist for this topic. Click here if you would like to attend an event.

New client proposal – January 2023

Does a stock outperform the stock market index? Does a stock outperform its sector? Does the sector outperform other sectors? Does the sector outperform the stock market index? The new return comparison tool provides the answers to these questions and much more. It is, as always, available for FREE in the NanoTrader trading platform.

Copy trades – January 2023

SignalRadar (FREE) is one of the most popular features in the NanoTrader platform. This new SignalRadar table was created by German trader Eric Wagner. The table is available in the store. The SR-Tool strategy looks for repetitive patterns, which occur on fixed dates and generated profits in the past.

Important round numbers – December 2022

Round numbers attract the market price. Support and resistance also tend to occur around numbers. The highest order volume is executed around round numbers. With the new round numbers tool, you can clearly mark round numbers in the chart. You can also define a zone around every round number. If the market price enters this zone, you'll get an alert.

Identify candlestick patterns – November 2022

Use the new detector tool. The new tool allows traders to automate the detection of 18 candlestick patterns in live charts. You can use the candlestick patterns as trading signals. The platform can automatically open a position when a pattern is detected.

The new 2-in-1 candles – October 2022

Trading in higher time frames can give better signals but is not necessarily fun and sometimes a bit boring. The 2-in-1 candle is the perfect solution. Candles in a smaller time frame, are shown in candles in a higher time frame. A cool solution! You can also see at a glance the main trend and the short-term trend. The new 2-in-1 candles are FREE in the NanoTrader platform.

20 special years in Paris – October 2022

Twenty years in a row WH SelfInvest is present with a booth at the trading fair in Paris. Congratulations to our manager Pascal Hirtz for his twentieth participation! WH SelfInvest is always happy when it can showcase its novelties and services to passionate traders like you. Try the demo of the latest NanoTrader version.

Information futures – October 2022

Two changes for futures announce themselves for 2023. The CQG monthly fee will be increased by € 3. Traders who do not manage their own risk properly and rely on our risk desk to do this for them will be charged € 50 per lot. This change, which only brings the fee up to the industry standard, will only affect the very small number of clients who do not responsibly monitor their own positions and leave it to our risk desk to intervene.

Prominent traders on the fair in Germany – October 2022

Just like every year WH SelfInvest had a prominent booth on the World of Trading fair in Frankfurt. A huge number of traders visited the stand to try our novelties. These visitors included famous traders such as André Stagge (1st from left), Carsten Umland (3rd from left) and Birger Schäfermeier (4th from left).

New: The VIDYA average indicator – October 2022

Trader Tushar Chande likes moving averages. He wanted to design a 'perfect' moving average. His VIDYA average automatically adapts to the market's volatility, and therefore does not have the disadvantages of traditional moving averages. Chande's average can be used as a trend filter or a trading signal. The VIDYA average is available in the platform FREE of charge.

New: The Histo Breakout strategy – September 2022

The new Histo Breakout strategy uses historic volatility data to identify points at which the market can break out of a price range. This day trading and swing trading strategy is easy to understand and use. Automated trading is possible. The Histo Breakout strategy is available in the platform FREE of charge.

New: The Polychromatic Momentum Indicator – August 2022

A new indicator is available in the platform. The Polychromatic Momentum indicator is frequently used for trading in smaller time-frames. It is a price momentum indicator. The Polychromatic Momentum indicator can also be used to indicate the trend and to provide trading signals. The PMI is available in the platform FREE of charge.

WH SelfInvest receives a major award – July 2022

You will be happy to know that your broker, for the 6th

time in a row(!), has been ranked #1 and BEST CFD BROKER

by the research team of the prestigious €uro am Sonntag

magazine.

#1 and Overall winner

#1 Product range and Order execution

#1 Pricing

New: The Swingcounter – July 2022

Identify, measure and trade price swings and price movements. The Swingcounter is used by Dutch trader Nico Bakker. Particularly in conjunction with some of the unique functionalities NanoTrader offers, such as the periods-high-low stop, the Swingcounter is worth exploring. The Swingcounter is available in the platform FREE of charge.

Start in 17 hours – July 2022

On Saturday, 16 July, the Börsentag München starts. You can learn everything about trading futures, CFDs, forex and stocks at our stand and in the fantastic Traders Lounge of WH SelfInvest. In the lounge you can meet all the German trading stars.

New client proposal: ZLEMA – June 2022

The Zero Lag Exponential Moving Average (ZLEMA) indicator was developed by John Ehlers. This indicator eliminates the intrinsic lag, which is associated with all trend following indicators. The ZLEMA is available in the platform FREE of charge.

The best broker – June 2022

"If you are not happy at WH SelfInvest, you will not be happy anywhere else." wrote the Fuchs Report. This rigorous broker study using mystery shoppers gave your broker a top score of 98/100. In addition WH SelfInvest is the best broker on the "Eternal Best Brokers" list.

New trading strategy – June 2022

The Rainbow strategy is based on the Rainbow moving averages from trader Daryl Guppy. It can be used for day trading on all instruments. It is a simple and user-friendly strategy. The Rainbow trading strategy is available for FREE in the NanoTrader platform.

Trade Euronext CAC 40 futures – June 2022

Clients can now also trade the Euronext Paris futures. The star product is the CAC 40 future. WH SelfInvest has been in the top 3 of the best futures brokers for over 10 years, usually in 1st place. Clients get real tick-by-tick quotes.

Trade Amsterdam AEX futures – May 2022

Clients can now also trade the Euronext Amsterdam futures. The star product is the AEX future. WH SelfInvest has been in the top 3 of the best futures brokers for over 10 years, usually in 1st place. Clients get real tick-by-tick quotes.

Finanzen.net Ratgeber very enthusiastic about Freestoxx – May 2022

The editors are fans of our simple, transparent offer for buying US stocks at the exchange price, without paying commissions. The writers are equally fan of the trading app and strongly recommend the demo.

Micro Copper futures released – May 2022

The CME has launched a Micro Copper future. The trading volume is good. There is no physical delivery, very convenient at maturity, traders do not have to do anything. The Micro Copper is 1/10 the size of the standard Copper future. Copper is a very important commodity and the price of copper is an indicator with predictive value for the world economy.

New stop based on Parabolic SAR – April 2022

The Parabolic SAR is a popular and good trend indicator. This store pack allows traders to place a stop loss order, which follows the Parabolic indicator. The profit target is also calculated based on the Parabolic indicator. The pack can be easily integrated into the NanoTrader.

New strategy from Larry Connors – April 2022

The new R3 trading strategy has a high proportion of profitable trades. It was designed by the well-known trader Larry Connors. The R3 trading strategy is available for FREE in the NanoTrader platform.

New: the Drawdown % calculator – March 2022

The new Drawdown % calculator allows traders to see the risk. It is quickly clear whether an instrument is making a normal move or an extreme move. Creative traders will discover many other applications. Have a look. This tool is FREE.

New: the SuperTrend Channel indicator – March 2022

A client suggested a trading channel based on the impressive SuperTrend indicator. The SuperTrend Channel indicator is now available for FREE in the NanoTrader platform.

We are very happy – February 2022

The 'Best CFD-Forex Broker' is a very nice award. Especially when it is the German consumer association (DKI) that has this opinion. Equally top is the award for our own trading platform NanoTrader. The 'Best Trading Platform' is a very clear statement!

Investui service delivers +17,5% for clients – January 2022

Clients with an Investui managed account and moderate risk saw their capital grow by +17,5% in 2021. This is the net return after all costs. All four Investui strategies were profitable. The profits were made gradually over the year, which proves the robustness of the Investui system.

New SignalRadar market monitor – January 2022

Two new SignalRadar tables have been integrated in the NanoTrader platform. Both tables monitor stocks, indices, forex and commodities in real-time. SignalRadar will inform you when something interesting happens. The Movers and Shakers table and the Moving Averages table are FREE for clients.

New crypto future – December 2021

This new crypto future is available for trading. Before starting, take a minute to read the special rules related to these futures. To activate trading of crypto futures on your account simply e-mail our support desk.

80 Free trading strategies – December 2021

The 80th trading strategy has been integrated in the NanoTrader trading platform. The ATR Channel Breakout strategy is a trend-following strategy. The trading strategy was described by Curtis Faith in his book “Way of the Turtle”. All clients can use the trading strategies for FREE.

3 Major events sponsored – November 2021

In the last month WH SelfInvest sponsored three major events: The World of Trading, the Welt Der Finanzen and the Crypto Convention. Readers interested in trading crypto assets can open a futures account or a crypto & stocks account.

50 Free client proposals – November 2021

The 50th client proposal has been integrated in the NanoTrader trading platform. The Fibonacci Moving Average is one of the best trend indicators. WH SelfInvest programs trading tools and indicators proposed by clients. The proposals are inserted into the NanoTrader. All clients can use the proposals for FREE.

The perfect coffee CFD – November 2021

Arabica coffee futures traded above $ 2.4 per pound in mid-November, its highest since October 2011. The price is expected to rise by +25% to $ 3.0 in 2022. Buying futures requires expensive ICE quotes and changing contracts at maturity. Too complicated. The perfect solution for investing in coffee? The WH SelfInvest Coffee CFD with no expiry date. You can simply buy and hold this CFD. We probably have the biggest CFD-Forex product range.

Significant reduction in margin requirement – November 2021

Our intraday futures margin was reduced to a highly competitive 20%. This allows clients to make the best use of their capital. WH SelfInvest always strives to give clients the best conditions.

A new Bund trading strategy – October 2021

The Trendscore strategy is available in the trading platform. The strategy is based on the indicator of the same name. This indicator was designed by the well-known trader Tushar Chande. The designer of this intelligent and simple strategy trades the Bund.It can also be used for other instruments. The Trendscore strategy is available FREE of charge in the NanoTrader platform.

A new forex trading strategy – October 2021

A new trading strategy is available in the trading platform. The HLHB Forex Trend-Catcher strategy is published on the Babypips website. It is a very simple strategy, which seems to deliver good results. There are a good number of trades, but the tempo is not too high. Beginners should definitely explore this strategy! The HLHB Forex Trend-Catcher strategy is available FREE of charge in the NanoTrader platform.

Best Futures Broker – October 2021

The "Salon du Trading" in Paris attracted many visitors. Traders were happy to visit the fair again. In what is becoming a tradition, visitors and organizers voted WH SelfInvest "Best Futures Broker". Clients praised the near-perfect order execution, the low fees, the useful tools for traders and the incredible trading platform.

Significant commission reduction – September 2021

Thanks to our good relationship with CME Group, we can lower the commission on Bitcoin futures. And when we say lower, we mean lower: -50%. For more than two decades, WH SelfInvest passes all benefits on to its clients. The lower commission will start on Tuesday 21 September. The new commission for Bitcoin futures, including the exchange fee, is $ 9,52 per lot per side. The commission for all other USD futures remains $ 2,20 excluding exchange fee and before volume discounts.

Investui service at +60,1% – September 2021

Investui had another outstanding month.Net return in August: +19,0%. This is plus € 4.719 on a futures account with € 25.000 invested at moderate risk! The total net return since 2020 now stands at +60,1%. Interest rates are negative and inflation is high. The value of money, which is not invested, is going down every single day.

New look and feel – August 2021

The design of the NanoTrader has been completely updated. The icons, colours and all other design elements of this fantastic trading platform have been drastically refreshed. No less than four colour versions are now available: Night View, Classic Blue, Silver and White.

Bull Power and Bear Power – August 2021

A new trading signal is available. The signal was designed by mega-trader Dr. Alexander Elder. The Elder Ray Index trading signal consists of two indicators: Bull Power and Bear Power. Dr. Elder's trading signal is available FREE of charge in the NanoTrader platform.

A great trend indicator – August 2021

A new client proposal is available in the trading platform. Jack Weinberg's TRI indicator is great to detect a trend. It is probably one of the best indicators to follow and trade a trend. The TRI indicator is available FREE of charge in the outstanding NanoTrader platform.

New technology 5x faster – August 2021

New technology has been integrated in the NanoTrader trading platform. This technology manages the loading and management of data, and in particular our specialty real tick-by-tick data. The platform is up to 5x faster. We have already received extremely good feedback from traders using tick charts, range bars, renko charts as well as strategies using a lot of data. The new technology is available FREE of charge for all clients.

New interest rate futures (in percent) – August 2021

The new CME interest rate futures are clearly aimed at the private investor. With four micro contracts (3x T-Notes and 1x T-Bonds) there is more than enough choice. Simplicity is key. Unique is that these futures do not quote in the price of the bond, but directly in the interest percentage they pay. If the interest rate is, for example, 0.25% and you think it is going to rise, you simply buy the future.

New Babypips strategy – July 2021

Forex traders will like this simple Inside Bar Momentum strategy. The strategy was published on the Babypips website. It is a day trading strategy. The tempo is perfect, not too fast and not too slow. The Inside Bar Momentum strategy is FREE in NanoTrader.

DowHow Fibo pack expands – July 2021

Markus Gabel's popular DowHow Fibo trading pack has been expanded. The TPO (Time Price Opportunities) module has been added to the pack. This seamless integration of DowHow Fibo and TPO will please volume-based traders. Both versions are available in the store.

Offer expands yet again – July 2021

The number of currencies available is now 23! They can all be traded on a bank account in your name. You can easily buy and sell these currencies against euros. The large number of available currencies serves all investors. Long-term investors can build a diversified portfolio. Traders and short-term investors have the largest range available.

New Gold Dumper strategy – June 2021

The new Gold Dumper trading strategy is based on a so-called market effect. A market effect is a pattern that regularly recurs in the market. The strategy is used by the German trader Holger Breuer. This trader takes advantage of the often weak gold prices in the morning. Given that the Gold Dumper only opens short sell positions, it is complementary for many traders who often only go long. The Gold Dumper trading strategy is FREE in NanoTrader.

New in the trading store – June 2021

The well-known programming company, SignalWorks, has created a new pack for the NanoTrader platform. The new pack focuses on Fibonacci lines. SignalWorks improves the Fibonacci lines and designs three up-to-date indicators for the modern trading world. The indicators all give Fibonacci trading signals. As we are used to from SignalWorks, it all looks very nice and every parameter, up to the smallest, can be set individually. This pack is available in the store for the bargain price of 99 €.

New CME future – June 2021

The new CME futures on digital assets are available for trading in your account. Before starting, take a minute to read the special rules related to these futures. To activate trading simply e-mail our support desk.

The new digital assets offer – May 2021

Find out in this analysis why our new offer could be perfect for your trading in this volatile asset class.

New offer + 10 free services – May 2021

The new 'Stocks & More' offer enables the active investor to buy stocks on 21 exchanges. The coin offer is equally spectacular. On top of this, every client gets FREE real-time quotes and access to 10 crucial investor services FREE of charge.

New funds offer, no custody fees – May 2021

The new 'Stocks & More' offers access to 20,000 exchange-traded funds (ETFs) and 10,000 investment funds from 200 managers. The necessary information to choose suitable funds is provided. On top of this, every client gets FREE real-time quotes and access to 10 crucial investor services FREE of charge. There is no custody fee.

More chart for the same price – May 2021

Good news for futures traders who are using the intraday charts. Starting 1st May, these charts will cover 5 days. In addition, charts for more futures will be available. The new 5-day charts are activated automatically when you log in in May. This increased service comes at no extra cost.

A new trading strategy – April 2021

The S&P 500 Night Rider strategy was added to the trading platform. This strategy trades in the late hours. The concept is based on the fact that the major market participants do not day trade but wait for the closing price to make major decisions. These decisions are then implemented. This is when the S&P 500 Night Rider strikes. The strategy is available to all clients FREE of charge.

Managed account delivers results – April 2021

As expected, March was a success. The futures reference account (moderate risk) rose by +18.6%. This brings the net result for the first quarter to -3.4% and the current result since 2020 to +29.5%. With nine months to go, there are still plenty of opportunities for good returns.

Seven years in a row – April 2021

"Best Futures Broker" for seven consecutive years. "Top 3 CFD-Forex broker" for seven consecutive year. For us this is a reward. For you, this means the best order execution, an unbeatable trading platform, a legendary service and really low rates.

New managed account – April 2021

You can now also give WH SelfInvest a management mandate to apply the popular Investui service to your account. This way you never miss one of these top signals. In 2020, Investui generated a net return of +33%. This management is FREE of charge.

A new client proposal – April 2021

The Advanced ADX indicator is an improved version of the traditional ADX. The ADX only shows the strength of the market trend. The Advanced ADX shows both the direction and the strength of the trend. A very useful indicator. This client proposal is available for FREE in the NanoTrader platform.

WHS does first Micro DAX Future trade on Eurex – April 2021

The Eurex futures market and broker WH SelfInvest have been partners for many years. The companies operate closely together on various events. WH SelfInvest was actively involved in the creation of the Mini DAX (1 point equals € 5). Today, 19 April 2021, the Micro DAX future (1 point equals € 1) was released. The Micro DAX future was particularly launched with an eye on the Asian futures market. Befitting broker WH SelfInvest's historic ties with the Eurex, we did the first trade at 15495.

Mini CFD Nasdaq – March 2021

Small Nasdaq trades have just become easy. A new mini CFD on the Nasdaq is available. The US Tech Mini has a value of $0.10 per point. This CFD is therefore worth 1/10 of the Nasdaq index. If the Nasdaq, for example, is at 12,800 then the US Tech Mini has a value of $1,280.

A new client proposal – March 2021

The FX Pair Finder identifies the best forex pair(s) to trade. Day traders can quickly see which currency is the strongest and which currency is the weakest. Ideally they trade the forex pair consisting of these two currencies.

Trading store – March 2021

The popular VWAP and TWAP package in the store has been expanded. Several suggestions from traders have been incorporated into this exciting new version. The package is now even better and more user-friendly.

A new trading strategy: the Trio strategy – March 2021

A new day trading strategy is available in the platform. The Trio strategy is used for forex trading. The strategy uses three well-known technical analysis indicators. It was developed by Wilhelm Eder in Traders Magazine. The Trio forex strategy is FREE of charge.

New client proposal – March 2021

The Hi-Lo tool is a simple yet fantastic idea. The trader chooses a period (hour, day, week, month...). The Hi-Lo tool then draws the highest and the lowest level in the chart. The trader is not limited to one choice. It is, for example, possible to show both hourly and daily levels in the same chart. This tool is FREE of charge.

'Best mobile platform', 'most beloved' and 'fairest broker' – February 2021

The respected Deutsches Kundeninstitut has finished its annual broker market study. DKI awarded WH SelfInvest first place. Best mobile trading platform, most beloved by traders and the fairest CFD broker were all awarded to WH SelfInvest.

New client proposal – February 2021

The Chart Compare tool allows the trader to compare the performance of two instruments. A stock against and index, a stock against a stock, an index against gold…. everything is possible. This tool is FREE of charge.

Learn how to trade like 1.000.000 others – December 2020

Do you want to know anything about trading? Visit our youtube channels. We always do a great effort to have interesting content. You can watch many famous traders. The channels are firing on all cylinders: German language 1.000.000 views, French language 500.000 views and Dutch language 100.000 views.

New in the store – December 2020

The WL SuperFive trading system contains all the major breakthroughs made by trader Wim Lievens over the last decade. The SuperFive system offers five specific types of trading: trend corrections, trend reversals, momentum trades, support & resistance tests and break-outs. Trading on all instruments and in all time frames is possible. The store pack includes coaching by Wim Lievens himself.

Airbnb and Doordash added to CFDs on shares offer – December 2020

WH SelfInvest has a huge CFD on shares offer. We are always quick to add new and important companies. The new stars, Doordash and Airbnb, just started quoting on the Nasdaq stock exchange. Clients can trade the CFD at exactly the same price of the underlying shares of the exchange. We do NOT have an extra dealing spread like most other CFD brokers.

Office move – December 2020

Our Luxemburg office has moved to a new location. Our

lease ended so it was time to move. The new address is:

Vitrum building, 2nd floor

Rue du Puits Romain 33

8070 Luxembourg-Bertrange

The Black Dog tool – December 2020

A new free tool has been added to the NanoTrader trading platform: the Black Dog tool.The Black Dog system is a well-known trading system for forex traders. The system trades in the direction of the trend and can be used to trade all forex pairs. The Black Dog tool is FREE.

A new trading strategy – November 2020

A new free trading strategy has been added to the NanoTrader platform. We are currently adding a series of trading strategies, which share two criteria: they are simple and they have been designed by well-known traders. The Break-in strategy is a simple day trading strategy. The Break-in strategy is somewhat unconventional. Like all the other integrated strategies in the NanoTrader platform, Break-in is FREE.

Futures: DAX change and Mini-DAX birthday – November 2020

The Mini-DAX future is now a healthy 5-year old toddler.

WH SelfInvest closely worked together with the Eurex to

launch the DAX future's smaller brother. Two interesting

facts illustrate its popularity: 46 million contracts have

been traded since the launch, and 70.000 contract are

traded every day.

On 21 December 2020 there will be a change in the

Mini-DAX's big brother. The main DAX future will start to

quote in 1-point increments instead of the current

0,5-point increments i.e. the smallest price move will be

1 point up or down.

People like CFDs – November 2020

The German CFD Verband has published the findings of market research they conducted earlier this year. The short conclusion is that people, for a multitude of reasons, like CFD-Forex and are happy with the CFD Verband member-brokers. The number of complaints related to CFD Verband brokers is extremely low. If you choose a CFD Verband broker, CFD-Forex is a source of satisfaction for traders and active investors.

Peace in MACD land – November 2020

A new free tool has been added to the NanoTrader trading platform: the MACD Zero line. The MACD is a technical analysis indicator, which proves its value in numerous trading strategies. There are, however, two ways of interpreting the MACD indicator. This has resulted in two camps with different opinions. The MACD Zero line indicator unites these two camps. It combines the two interpretations into one signal. The MACD Zero line is FREE.

Investui 2020 profit reaches +36,6% – November 2020

The net profit on the Futures reference account (€ 25.000, moderate risk) grew to a staggering +36,6%. A new record, with still two months to go in the year. Last month the net profit stood at +26,4%. In short, +10,2% were added to the performance. In money terms, the account added € 2.562 in 30 days. Over the same period the DAX lost -3,0%. Both the S&P 500 and Gold added +3,0%.

A new trading strategy in NanoTrader – October 2020

The Breakaway Gap strategy was designed and is used by a well-known German trader. The strategy combines a specific type of gap, a breakaway gap, with a market break-out. The combination of a gap and a break-out is particularly powerful and perfect for finding fast-moving instruments. Harald Weygand’s strategy automatically detects price gaps which exceed a certain size and which break through at least one of four moving averages. Like all the other integrated strategies in the NanoTrader platform, Breakaway Gap is FREE.

Trade of the week – October 2020

Every week Investui sends a short, precise e-mail containing a notable trade. The trade is done on the real account and is based on the Investui alarms. The trade of the week e-mail is only send to Investui prospects. If you are not yet a prospect, you can simply register for the newsletter on the Investui website. You will start to receive these new "trade of the week" e-mails.

New tool in the store – October 2020

The SR-Tool is based on the premise that market prices don’t move randomly but are subject to causality. Causality means that the market price shows identical price patterns at the same time every year. The SR-Tool quickly detects repetitive annual price patterns over five (or more) years and highlights the patterns in the chart. A very interesting tool designed by a client.

Let your money work for you – October 2020

The Investui service is now also available in English. Clients receive e-mail alerts for gold, DAX, S&P 500 and GBP/USD. The strategies are based on academically proven market effects. An alert can be converted into a real position in one click. The position will be opened and closed. The Investui alarms deliver really outstanding returns.

Daytrading volatile US stocks – October 2020

We offer a huge range of CFDs on stocks. The WL Vola Open daytrading strategy combines the best of NanoTrader (automated orders, multiple targets...) with the skills of a professional trader. Wim Lievens updated his popular strategy. Stocks whose volatility dropped, have been replaced with very volatile stocks. He also fine-tuned the trading ranges for all 50 stocks. If you don't own the WL Vola Open strategy, it is available in the trading store.

A new trading strategy in NanoTrader – September 2020

The Daily DAX strategy was designed to show that day trading can be simple. Two basic technical concepts are combined with the awesome testing and improvement power of the NanoTrader platform. In addition the NanoTrader provided a precise hour to open a position, avoiding traders to sit and wait for a signal. Like all the integrated strategies in the NanoTrader platform, Daily DAX is FREE.

The press is enthusiastic – September 2020

A big newspaper and a major website reported positively on Investui. The famous Die Welt newspaper was impressed with the profits, which investing in market effects can generate. Finanzen.net sums up Investui's advantages as follows:

- The possibility for investors to invest in a professional manner.

- Low costs, as there are no fixed costs and only low fees.

- Diversification due to different asset classes and markets.

- Easy to use, as e-mail notifications can be converted into positions with one click.

International Federation of Technical Analysts – September 2020

In October the IFTA organizes its 33rd annual conference. This year, the conference is hosted by the Association of Technical Analysts in Germany (VTAD) – yet it does not take place in Germany. It will be worldwide, hosted in a digital virtual space. The speakers include famous technical analysts like John Bollinger, Larry Williams, Daryl Guppy, Dr. Van Tharp and Linda Raschke. Only one broker, WH SelfInvest, has been invited to provide a speaker for this prestigious event.

Trump Index and Biden Index – September 2020

Known for innovation, we have launched a 'Trump 30' index CFD and a 'Biden 30' index CFD. Each index consists of 30 companies, which are set to benefit if Trump or Biden are elected as US president on 3 November 2020. The 'Trump 30' and 'Biden 30' CFDs are now available in your trading platform.

Same chart, different time frames – September 2020

This new pack in the store (programmed by SignalWorks) allows traders to insert indicators in a higher time frame, in a main chart with a lower time frame. For example, it is possible to show Bollinger Bands based on 60 minutes in a main chart with a time frame of 10 minutes. The indicators in the higher time frames can be used to identify the trend and other such key information, the chart in the lower time frame is used to find ideal entry points.

New index: Remote economy – September 2020

Another new release is our 'Remote Economy' index CFD. The index consists of 20 US companies. These companies will benefit most if the current Corona pandemic results in a permanent shift to working from home (the remote economy). If you think this will be the case (or not, for the short sellers), this CFD allows you to take a position. The index is available in the platform.

« Respect ! » – August 2020

The reputed finance magazine "€uro am Sonntag" tested 12 CFD-Forex brokers on more than 750 criteria. This detailed broker comparison concludes WH SelfInvest is the best broker and the company is rated "the overall winner". The broker scored well across all categories and achieved exceptional scores in the key categories: trading platform, order execution and order possibilities. With these words €uro am Sonntag confirms WH SelfInvest is the best broker: “The winner is, again, WH SelfInvest. The fourth year in a row. Respect!”.

A new trading strategy in NanoTrader – July 2020

This strategy combines the visually attractive Parabolic SAR with icon Welles Wilder's ADX. A filter filters the signals. A unique trailing stop based on the Parabolic SAR protects the position. The back-test give variable results, but the stop is very interesting. Like all the integrated strategies in the NanoTrader platform, Parabolic Combo is FREE.

Outstanding returns from our Investui service – July 2020

The net return after costs of the 'moderate risk' futures accounts has reached +14,2%. The 'moderate risk' CFD-Forex account is also positive with a net return after costs of +2,1%. The gross return of the 'aggressive risk' account currently stands at +68,1%. Further good results are expected.

What more can we say? – July 2020

The annual Investment Trends report has been released. It is a professional analysis of brokers, based on 7000 trader opinions. For an astonishing 10(!) years in a row broker WH SelfInvest has the highest client satisfaction. This broker, as usual, came first in 14 out of 20 service categories, including order execution, service and platform.

A new client proposal – June 2020

Volatility is key. The Volatility Blocker indicates volatility in ticks, points or percentages. More importantly, it shows the trader when volatility increases and when it decreases. The tool can be used as part of a trading strategy (opening a position when the volatility increases is preferable to opening a position when the volatility decreases) or simply to automatically block trading signals. The Volatility Blocker is FREE.

A new trading strategy in NanoTrader – June 2020

The Triangles strategy uses two technical analysis favourites: the ascending triangle and the descending triangle. Every parameter in this strategy can be set by the trader. The triangles are drawn automatically. Positions are surrounded by a profit target, a stop loss and a time stop. Like all the strategies in the NanoTrader platform, Triangles is FREE.

New pack designed by a professional trader – May 2020

DowHow Fibo is the trading method of German trader Markus Gabel. The DowHow Fibo pack in the store has been designed by Markus himself. His method is based on four pillars: Charles H. Dow’s famous Dow Theory, Markus Gabel’s knowhow, Fibonacci’s numbers sequence and reversal chart patterns as entry signals. DowHow Fibo is fully automated and supports the trader in many ways. Buy this NanoTrader pack or test it one month.

A new client proposal – May 2020

This simple cool tool indicates for any instrument which days of the week are the most volatile. The most volatile days of the week are the most interesting for traders. The tool can be used for market indices, forex pairs, commodities and even individual stocks.

A new trading strategy in NanoTrader – April 2020

The Weekend Oil strategy is used for day trading US WTI crude oil. The strategy only trades on Friday and does only one trade. Weekend Oil is easy to understand and easy to implement. The back-test looks good. The strategy is based on a market effect. Market effects give traders a statistical advantage. If you are interested in market effects, visit our related website Investui. Like all the strategies in the NanoTrader platform, Weekend Oil is FREE.

New market index: Cannabis – April 2020

A thematic index has been added to the CFD-Forex product range. The Cannabis index is designed to capture the market performance of the top 20 companies, measured by market capitalization, with more than 50% revenue exposure to the cannabis industry (cultivation, production of derivatives, biotechnology, commercialization and secondary services) and traded at global, liquid stock exchanges.

Two new market indices: Green and ESG – April 2020

The Green index captures the Total Return Performance of the 30 largest companies from the BITA Green Institutions Universe, based on market capitalization, that are listed and traded at recognized, regulated North American stock exchanges. The ESG (Environmental, Social, Governance) index is captures the Total Return market performance of the top 100 companies of the BITA US Universe, ranked and weighted according to their ESG Rating Score.

New market index: FAANGs – April 2020

A thematic index has been added to the CFD-Forex product range. The FAANGs index (Facebook, Amazon, Apple, Netflix, Google...) is designed to capture the Total Return Performance of the top 10 traded companies listed at the Nasdaq Stock Exchange.

Good news from Investui – April 2020

The reference accounts are positive again for the year. The 'aggressive' account now shows a gross return of +39,2%. The two real money 'moderate' accounts show a nice net return of +6,1% and +5,6%. In short, losses due to the Corona-crash have been recuperated.

Facts speak louder than words – April 2020

Six years in a row voted "Nr. 1 Futures Broker". Four years in a row voted "Nr. 2 CFD Broker". Six years consistently in the Top 3. Open an account and discover how good WH SelfInvest is. It will completely change your trading experience.

The Twenty Entry – Three Exit strategy – April 2020

In spite of its somewhat cryptic name, the strategy is easy to understand and to implement. Twenty Entry – Three Exit is a mean reversion strategy. The strategy’s designer, Joachim Struck, concentrates on day trading forex but the strategy can also be used on other instruments. Traders who want something simple, should explore this strategy.

Even more free historical data for CFD-Forex – April 2020

Free extensive historical data is now available for the following forex pairs: EUR/AUD, EUR/CAD and EUR/PLN. The extensive historical data is available in ticks (4 days) and 1, 5, 30 and 60 minutes aggregation. Simply go to the trading store and activate this FREE historical data. The NanoTrader is a back-testing and trading strategies power house.

Fourteen Pivot Points in Pack 2 – March 2020

Pivot Points Pack 2 has been added to the trading store. The pack contains 14 different Pivot Points. For each type of points the charts also show the Pivot Range. Besides different calculation methods such as Fibonacci and Camarilla, pack 2 also contains Pivot Points for day traders such as rolling, session and hourly Pivot Points.

A new client proposal in NanoTrader – February 2020

An indicator proposed by a client has been added to the NanoTrader trading platform. The ATR Expansion Day indicator is used by the well-known German trader Birger Schäfermeier.This indicator visualizes a sudden day of high volatility after a period of lower volatility. Hence the term ‘expansion day’. Some traders use this indicator also as a trading signal. Like all client proposals this indicator is FREE.

The Safety Net – February 2020

The NanoTrader is the best platform for all automated trading. The Safety Net allows smart automated trading. The trader sets conditions (maximum loss reached, maximum profit reached, maximum draw down reached etc.) and the Safety Net stops automated trading and closes the position.

A Stock-Box milestone – February 2020

The return on the Nasdaq 100 Outperfomers stock-box passed the +100% level. This stock-box is available since November 2016. It contains eight Nasdaq stocks. These eight stocks are selected on the basis of Nobel prize winner Professor Eugene Fama’s theory of outperformance. If you are interested in a stock portfolio, which always contains outperforming stocks, consider the Stock-Box service.

A perfect score – February 2020

Due to its all-round perfect performance WH SelfInvest obtained the categories “Fairest CFD Broker”, “Traders Favourite” and “Trading Platform”. With perfect scores (5/5) in the categories order execution, order possibilities and overall satisfaction WH SelfInvest was awarded, once again, the label “Very Good”. The legendary client service was also labelled “Very Good”.

Free trading App – February 2020

The CQG mobile trading app has been reduced from € 25 per month to ... 100% FREE. This is possible due to the good relationship between WH SelfInvest and CQG. As always at WH SelfInvest, price reductions are passed on to the clients. Existing users will see the fee disappear in the current month. Non-users, if interested, ask for activation.

New Investui service – February 2020

Let your money work for you. Investui is a service for investors with limited time who would like to invest in gold, currencies and market indices. You receive precise e-mail alerts. The strategies are based on academically proven market effects. In one click an alert can be converted into a position.

We are impressed, says Fuchs – January 2020

Fuchs Briefe just published their annual consumer report based on mystery shopping. WH SelfInvest is the “Best Broker for 2020” and the number 1 on their “Consistently Best Brokers” list. With a score of 97/100 WH SelfInvest is rated as outstanding. Fuchs writes “We are particularly impressed with the following: WH SelfInvest lives and breathes personal contact. When we call, we always reach a human being and never get an answering system.” The broker report concludes “WH Selfinvest is once more the yardstick by which others should be measured. This applies to the highly professional trading platform and even more so to the perfect personal service. This broker's offer undoubtedly satisfies every trader's wishes.”

A new client proposal in NanoTrader – December 2019

An indicator proposed by a client has been added to the NanoTrader trading platform. The BB MACD indicator is a combination of two technical analysis indicators, which have proven their value: the Bollinger bands (BB) and Moving Average Convergence Divergence (MACD). Some traders use this indicator also as a trading signal. Like all client proposals this indicator is FREE.

A new trader in SignalRadar – November 2019

The huge success of the SignalRadar motivates André Stagge to offer a live trading table. The table shows real-time trades based on his Morning Break Out strategy. André Stagge uses the strategy to trade the DAX but states it can also be used to trade European stocks. These are the trades shown in the SignalRadar table. Both SignalRadar and André Stagge’s table are FREE.

André Stagge breaks out – October 2019

In order to satisfy popular demand, trader André Stagge has released one of his day trading strategies in the NanoTrader platform. André Stagge uses his Morning Break Out strategy to trade the DAX index. He has defined a specific range and waits for break outs. Once a break out occurs, he uses precise rules for managing the position. The Morning Break Out strategy can also be used for stocks and other market indexes according to André Stagge.

The Red-White-Red pattern, signal and strategy – October 2019

An Austrian trader shares his swing trading strategy with all clients. Red-White-Red is a candlestick pattern. It is available for free in the NanoTrader platform as a pattern, which is detected automatically, as a signal and as a trading strategy. The trader has valuable rules to get a quick grip on his risk and to manage his position. These rules are maybe the key element in the Red-White-Red strategy. Read a complete article.

More commodity CFDs without expiry dates – September 2019

CFDs on commodities usually have an expiration date. After the great success of our non-expiring oil CFDs, we have introduced three additional non-expiring CFDs. These new CFDs are based on the commodities coffee, cotton and sugar. Non-expiring CFDs allow clients to have longer term exposure to commodities markets without ever having to roll their position. Simple and easy.

New online account application … 5 minutes max – September 2019

The new online account application process allows you to quickly open a trading account. The process is easy and efficient, the interface is user-friendly and intuitive. A trading account can be opened in less than 5 minutes.

New trading strategy: the Black Candles strategy – September 2019

Another free trading strategy has been added to the NanoTrader platform. The Black Candles strategy shows a unique Heikin Ashi trading channel. Sensational is the fact that the strategy’s charts combine this unique channel with regular candles but in a much lower time frame. This ensures a better quality trading signal whilst still allowing the trader to see all market action.

Italian trader shares Z-Candle Plus strategy – September 2019

This Italian trader and long-time NanoTrader fan designed his own candles, the Z-Candles. These candles are an improved version of the popular Heikin Ashi candles. The strategy combines the Z-Candles and another traders’ favourite: Renko charts. A cool visual aid results in clearly visible signals.

226 kilometers in 24 hours – September 2019

Marko Gränitz did it again! The runner sponsored by WH SelfInvest ran no less than 226 kilometers in 24 hours. The German champion finished first in his age category and third overall. Like Marko Gränitz, WH SelfInvest, always goes the extra mile for its clients.

New trading strategy. NLO for Nasdaq Long Only – August 2019

Another free trading strategy has been added to NanoTrader. This brings the total to 64 free trading strategies. The NLO strategy only buys the Nasdaq market index and it only buys on bullish market days. In theory the perfect combination? Proven concepts such as multiple targets and a break-even trailing stop are also part of this strategy.

Personalize store products, strategies etc. – August 2019

The new customization settings make it possible to change the look and feel of every store product, strategy and client proposal integrated in the NanoTrader platform.

The first 10.000 € profit for clients was reached – August 2019

The Mail & Click service delivers a combined profit of more than 10.000 € for clients (trade one future or the equivalent in CFDs). This cape was rounded after 9 months. All WH SelfInvest clients have FREE access to the Mail & Click service.

Two new clients proposals – July 2019

Two new tools proposed by clients have been added to the NanoTrader trading platform. The fractal channel is an original way of drawing and using support and resistance levels. The KDJ indicator is a simple yet comprehensive indicator. This indicator is used by some traders as a trading signal when day trading.

"Best order execution" and "Best broker" – July 2019

The influential German magazine €uro am Sonntag compared 12 German CFD-Forex brokers. Once again WH SelfInvest was declared the best CFD-Forex broker. Of crucial importance for CFD-Forex traders is the pricing and the order execution. WH SelfInvest is first in both these categories!

New mobile trading platform for CFD-Forex – July 2019

A new platform for web, tablet and smartphone is available. In particular the new charts are impressive. The number of technical analysis tools is huge. Personal lay-outs can be saved. A news service is included. The platform is available via the Clients page.

First place in 14 service categories – June 2019

The Investment Trends research company has a reputation for delivering the most respected broker comparison. The conclusion from talking to more than 5.000 traders is clear: "WH SelfInvest leads the [brokerage] industry in overall clients satisfaction and in 14 of the 16 key service areas measured."

- Customer service

- Value for money

- Quality of execution

- Spreads

- Trading platform features

- Risk management tools

- Trading ideas and strategies

- Commissions

- Education materials and programs

- Range of markets and forex pairs

- Ease of use of platform

- Reliability of trading platform

- Leverage and margin requirements

- Charting

"The best service, the best platform, the best order execution whilst still being declared the leader in low commissions, low spreads and value for money. This is what we want to deliver and what we promise to deliver even more in the future." stated Pascal Hirtz, founder of WH SelfInvest.

New free trading strategies. Traders' magazine pack – June 2019

This FREE pack contains three break-out strategies. The strategies were published in Germany's popular Traders' Magazine. The pack contains two day trading strategies and one swing trading strategy. The strategies can be traded manually or (semi-)automatically. Clients can activate the Traders' pack in their NanoTrader for free via the store.

Another 1st place – June 2019

This time it is not WH SelfInvest but the WH SelfInvest sponsored ultratrail runner Marko Gränitz who achieved another first place. This weekend Marko became German Ultratrial champion in his age category. He finished the 78 km Pfälzerwald run, which included no less than 3000 meters of climbing, in fourth place overall and first in his age category. Congratulations Marko on becoming the German ultratrail champion.

Mail & Click service available in France – June 2019

The groundbreaking Mail & Click service, available in our German branch since November 2018, has been rolled out to the French branch. All other branches will follow soon. The Mail & Click service sends clients trade signals from reputable trading strategies on their mobile telephone. One click is sufficient to open and close a position. Clients using the FREE Mail & Click service have made a very impressive profit of 8450 € since the service was launched.

New Profit-lock stop order – May 2019

The Profit-lock stop order solves a classic trader dilemma. What to do when you have a position and the market makes a sharp unexpected price move in your favour? Close the position immediately and forego more potential profit? Move your stop up? To which price level? The Profit-lock stop recognizes sharp price move patterns. It puts your stop automatically at the 'perfect' level, effectively locking-in the profit and leaving the door open for additional profit.

New order types – May 2019

Create an order whenever you want, and specify a time when the order must be activated. It is also possible to specify a time when the order must be cancelled later on. A time instruction can be added to market orders, limit orders and stop orders.

New trading strategy. D&D Range Bar Scalping – May 2019

The free trading strategies offer in NanoTrader has been expanded with a scalping strategy. D&D is short for DAX and DOW. This exciting strategy is specifically designed for scalpers wishing to trade these two famous indices. A very interesting aspect of the D&D Range Bar Scalping is its evident ability to also find trading opportunities when these two markets are not volatile.

Best futures broker in France... third time in a row – April 2019

During this year's Technical Analysis fair in Paris WH SelfInvest was awarded for the third time in a row the Grand Prix de l'Excellence, Best Futures Broker. The award was handed over during the 20th edition of the fair, which was exceptionally held at the foot of the Eiffel tower to mark the occasion. WH SelfInvest itself celebrated its 20th birthday last year.

New client proposal. The percentage change tool – April 2019

This simple yet efficient tool allows traders to precisely measure the size of any market movement. The size of the movement is measured in percent. Market movements can be measured between any two points in time in any chart.

First and second place for WH SelfInvest – April 2019

In the annual Brokerwahl traders voted WH SelfInvest as "Nr. 1 Futures Broker" and "Nr. 2 CFD Broker". For an incredible five times in six years WH SelfInvest is considered the best futures broker, beating all competitors by a wide margin. In CFDs WH SelfInvest came only 0,1 behind this year's first-placed broker. Clients are extremely satisfied with the low commissions, outstanding order execution and the legendary service. A big thank you to EVERY person who voted for WH SelfInvest.

New client proposal. The TDI indicator – March 2019

A new client proposal has been added to the NanoTrader platform. The Traders Dynamic Index (TDI) indicator is a popular indicator for trend following strategies. This versatile indicator combines all key elements, momentum, trend and volatility in one single clear signal. It is therefore easy to understand the attraction of this indicator. The TDI brings the total of client proposals integrated in the NanoTrader to 32.

Additional trading platform. NinjaTrader for CFDs, forex and futures – March 2019

The NinjaTrader trading platform has a good reputation in the trading community. Frequent innovations result in a platform, which is always up-to-date and equipped with useful tools and features. Clients therefore benefit from the combination of an excellent broker with a legendary service and a huge product range and a trading platform with a solid track record. NinjaTrader allows trading of CFD, forex and futures.

New trading tool. Improve your trading strategies – March 2019

Is your trading strategy based on following the trend? Would you like to improve your trading strategy? The Mogalef trend filter designed and used by French trader Eric Lefort can identify up to eight different trends. Test your strategy in each of the eight trend situations. Add the Mogalef filter to your strategy and it will only provide signals in trend situations which are optimal for you.

New trading tool. The Volume Viewer – February 2019

The Volume Viewer makes futures charts even more useful and exciting. All order volume information is shown in real-time in the charts. The speed of market movements, the quantities traded, big orders... everything is visible. For volume-based trading and for scalping strategies, the Volume Viewer is an outstanding tool. The Volume Viewer:

- Displays the order volumes as an animation in the charts.

- Can be used on any futures contract.

- Provides actionable information for scalping and day trading.

- Is FREE for futures clients. Activate via the store.

Outstanding results at the Deutsche Kundeninstitut – February 2019

"With great pleasure we inform you that WH SelfInvestobtains a final note of 5 out of 5 stars and finishes with the score "extremely good". Congratulations!". These are WH SelfInvest's results in the different categories:

- Order execution: 5 out of 5 stars. Score: "extremely good".

- Trading platform: 5 out of 5 stars. Score: "extremely good".

- Mobile platforms: 5 out of 5 stars. Score: "extremely good".

- Service: 5 out of 5 stars. Score: "extremely good".

- Order possibilities: 5 out of 5 stars. Score: "extremely good".

New trading strategy. Daytrade volatile stocks (Apple, Facebook...) – February 2019

Professional trader Wim Lievens shares his daytrading strategy for US stocks. The exciting WL Vola Open strategy is perfect for people who want to daytrade and who are looking for volatility. The strategy is very ingenious yet easy to use. Applying the strategy correctly can be automated in the NanoTrader. Charts for 50 stocks and four market indices are set-up ready to use. You have nothing to parameter. And... buyers of the strategy in the store get a permanent reduction of -43% on the minimum commission for CFDs on US stocks.

- Read more about SignalRadar and install the app Test a NanoTrader demo including the full SignalRadar Open a trading account

Best SignalRadar trades in the platform – February 2019

The popular SignalRadar shows live trades done by different trading strategies. Clients can do similar trades and draw interesting conclusions. If three strategies have gone long on the EUR/USD, it may be worth taking a look at the EUR/USD. Towards the end of the day a short overview of some of the best trades is shown. The overview appears in the news section of the NanoTrader trading platform.

Free newsletter: Trading signals based on technical analysis – January 2019

Receive a daily free e-mail containing personalized signals based on technical analysis. You can simply configure your own newsletter by combining the stocks, market indices and forex pairs you are interested in with the indicators and strategies of your choice. Market analysis just became easy!

New trading strategies: two strategies from a famous trader – January 2019

Two new free trading strategies have been added to the NanoTrader Full trading platform. Both strategies are used by famous German trader René Wolfram. The Pound Shorter and the S&P 500 Break-out strategies are easy to understand and implement. The trading tempo is low. This brings the total number of free strategies integrated in the trading platform to 62.

Technical analysts prefer WH SelfInvest – January 2019

The German association of technical analysts (VTAD) polled its members for their preferred broker. WH SelfInvest is the members' clear favourite due to its excellent trading platform NanoTrader containing many free technical analysis tools. Source: VTAD.

Spreads reduced by -50% – December 2018

Trading CFDs became even cheaper. On several popular CFDs the spreads were significantly reduced. Another reason why WH SelfInvest is always rated in broker comparisons as offering extreme value for money.

New trading tool. Multi-target position manager – December 2018

Many traders open and close positions in steps. Particularly when targets are close to the entry price, all target and stop orders need to be placed quickly i.e. automatically. The NanoTrader Full can manage every combination and every number of target and stop orders on a position. Therefore this tool is just one example. These are the advantages of this free multi-target tool:

- Automatically places three profit target orders after you open the position.

- Automatically places a break-even stop order.

- Can be used on all instruments.

NanoTrader most popular platform – December 2018

On this year's World of Trading fair the live trading event attracted large audiences. NanoTrader is the preferred trading platform of the (professional) traders who competed in the live trading event. Four out of five traders on the event stage use the NanoTrader for their trading.

Number 1 on the "consistently best brokers" list – November 2018

The renowned Fuchs Briefe have again ranked WH SelfInvest as "Top-Broker". With the maximum points in the sub-categories "offer", "service" and "education" and a total of 96 out of 100 points the rating is "Excellent". "The performance is first-class, NanoTrader is outstanding and the personal client service sets benchmarks for the industry." With the best average score of over 7 years, WH SelfInvest maintains its 1st place in the prestigious "Consistently Best Brokers" list.

André Stagge strategies pack – November 2018

Trader André Stagge has integrated eight trading strategies in the NanoTrader trading platform. The eight strategies are available in one pack in the trading store. Some well-known strategies are included like the Zinshamster, the Friday silver surfer and the Short superstar. All strategies are suitable for short swing trades.

New trading tool. The range bars viewer – November 2018

Range bars are getting more and more popular. With range bars it is not always easy to estimate at what price level the next range bar will appear. The range bars viewer indicates where the next range bar will appear in a chart. For the trader it is now easy to see when a big price move occurs.

Volume Profile and Time Price Opportunities – September 2018

Two exceptional trading tools have been added to the trading store. Volume Profile is an advanced charting tool. It displays the trading volume and activity at different price levels. Price levels important to big traders become visible as an histogram plotted in the chart. Time Price Opportunities is a graphic which plots market data based on auction market theory. Both tools make the key price levels, such as the Point of Control (POC) and the Value Area (VA), clearly visible. This information allows traders to make intelligent decisions for their entry, stop and target.

Stock-box positions in SignalRadar – August 2018

Are you interested in the popular Stock-box service? We believe in transparency so you can make an informed decision. Every position in every Stock-box is now visible in the free SignalRadar app. Install the app (Androïd / iPhone) and decide if you want to use the stock-box service like many investors before you.

Stock-box service: the fireworks continue – August 2018

Two stock-boxes reached a high in August. In less than

two years stock-box service clients of the first hour have

obtained the following returns:

• The Recommended Stocks: +16,9%.

• The MSCI Outperformers: +23,6%.

• The DAX Outperformers: +23,9%.

• The NASDAQ Outperformers: +55,3%.

• The Rockets: +31,0%.

A new trader in SignalRadar – August 2018

The huge success of the SignalRadar motivated Michael Voigt to offer a free live trading table based on Markttechnik. All trades are visible in real-time. The table contains a limited number of instruments in two time frames. Markttechnik can be used on all instruments in all time frames. If you want to find more Markttechnik trades, you can purchase Michael Voigt's own tool in the trading store. The SignalRadar and Michael Voigt's table are FREE. Download a trading platform demo or the app (Androïd / iPhone). Both contain the Markttechnik live trading table.

€uro am Sonntag: “The cheapest broker and the overall winner” – July 2018

The reputed finance magazine "€uro am Sonntag" tested 13 CFD-Forex brokers on more than 733 criteria. In this extensive test of the brokerage sector, WH SelfInvest once again came out on top as the "overall winner". We scored well across all categories and exceptional scores were achieved in the key categories: low cost, trading platform, order execution and order possibilities. €uro am Sonntag confirms that WH SelfInvest is the best broker for every type of trader, combining high quality with low costs: "Traders who value low costs are best off choosing WH SelfInvest".

60 free trading strategies – June 2018

Two new strategies developed by portfolio manager André

Stagge have been added to the NanoTrader platform. Both

strategies have a slow pace and a specific day to place the

trade – Tuesday and Thursday. They are easy to understand and

ideal for part-time traders. The “Turnaround Tuesday” strategy

focuses on the Dax and will, as the name says, only give a

signal on Tuesdays. “The Friday Gold Rush” is a strategy

developed for trading Gold and will only place trades on

Thursdays. These 2 strategies now bring the available

strategies in NanoTrader to 60.

Read more about the Turnaround Tuesday

strategy.

Read more about the Friday Gold Rush

strategy.

A great birthday present: WH SelfInvest is the best broker – June 2018

“WH SelfInvest is the clear leader in overall client satisfaction. We have never seen client satisfaction ratings this high.” Irene Guiamatsia, Research Director, Investment Trends, states. Besides having the highest overall client satisfaction, WHS is ranked #1 in no less than 10 out of 16 categories. These include key service components such as customer service, quality of order execution, trading platform, platform reliability, trading ideas and strategies, range of instruments and currencies, and charting. “We are happy to see that our clients are very satisfied. The relentless focus on fair and fast order execution, trading platform and tools and ever lower spreads and commissions is appreciated by active investors. I invite all active investors to try WH SelfInvest. WH SelfInvest was founded in 1998 and celebrates its 20th birthday this year. We could not wish for a better present.” (Pascal Hirtz, MD)

New screener, chart pattern and signal. The popular Inside Bar Break-out – June 2018

Inside bars usually appear after a strong market move. They indicate a period of market consolidation. After consolidation the market will often make its next major move. Inside bars, however, can also occur at specific market turning points and are therefore also used as promising reversal signals. The German trader Michael Voigt in "Das große Buch der Markttechnik" also uses Inside bar patterns as the price level where he places his stop loss orders. His Inside Bar stop is available in the NanoTrader. Read more about the Inside Bar Break-out.

New trading tool. The best time to trade during the day? – May 2018

The HVH (hourly volatility histogram) shows traders which hours of the day an instrument is most volatile. The most volatile periods of the day are the most interesting for traders. Movement equals profit opportunities. The HVH:

- Indicates the best time to trade.

- Displays the size (%) of the volatility.

- Can be used on every instrument.

- Is easy to use and easy to understand.

- Is free. The HVH can be found in the NanoTrader in the WHS Proposals folder.

- Read more about the unique SignalRadar Free NanoTrader platform, including SignalRadar Androïd Iphone

New traders in SignalRadar – May 2018

The huge success of the SignalRadar live trading tool motivated Wieland Arlt (Expander strategy) and Wim Lievens (WL 0800 strategy) to launch SignalRadar tables based on their strategies. All trades triggered by their trading strategies are now visible in real-time in SignalRadar. SignalRadar is FREE.

Famous trader indicators added to NanoTrader – May 2018

The "Global Trend Analysis System" (GTAS) method was designed by proprietary trader and ex-fund manager Bernard Prats-Desclaux. His proprietary indicators are: BSI, S-Trend, FibTdi and Power. These four indicators can be used in all time frames and on all instruments. Although the indicators can be used individually they are, in the GTAS method, used together.

Stock-box service: +6,87% in one month – May 2018

The solid performance continues for stock-box clients. All stock-boxes had a positive return in April...

- The Recommended Stocks: +6,87%.

- The MSCI Outperformers: +3,26%.

- The Rockets: +2,38%.

- The DAX Outperformers: +1,85%.

- The NASDAQ Outperformers: +1,29%.

The Stock-box service is a low cost administration service for stock portfolios. The administration of the portfolios is done on the basis of an objective principle called the Momentum principle. The Momentum principle was discovered by Eugene Fama, who was later awarded the Nobel Prize for his work.

- Read more about the unique SignalRadar Free NanoTrader platform, including SignalRadar Androïd Iphone

New live trading tool: SIGNALRADAR – April 2018